The Internet and the Crash of 2008

By Andrew Smith

The Stock Market Crash of 2008 was devastating to millions of Americans but came at a time of general prosperity. Although there were concerns about the housing market and gasoline prices had hit record levels that summer, there were many signs that the economy was fundamentally strong. The behavior of investors seemed to be irrational—almost as if some force other than economic was driving the decline. Experts have debated all of the possible causes from declining “consumer confidence” to “short selling” to the fact that it was an election year. Undoubtedly there were many factors involved. Is it possible that the Internet itself contributed to the market’s decline?

Over the past several years the marketplace has changed radically, and this is largely due to the revolution created by Internet trading. Prior to 1995, individual investors gained access to the financial markets almost exclusively through full service brokers, discount brokers, or mutual funds. Since then, on-line services like E-Trade, Ameritrade, Scottrade, and others have allowed millions of ordinary investors with relatively limited funds and knowledge the ability to participate in the markets. At the same time, the Internet has given us 24/7 access to information around the world at increasingly faster speeds. While almost all would agree that this free access to information is one of the great social benefits of the Internet, it is also a completely unregulated and unedited source of information. This characteristic has lead to many “urban legends” and disinformation being spread as well. In his book, The Cult of the Amateur, English author Andrew Keen makes the case that that the web is dumbing itself down by replacing the authoritative knowledge of experts with the flawed “wisdom of the crowd.”

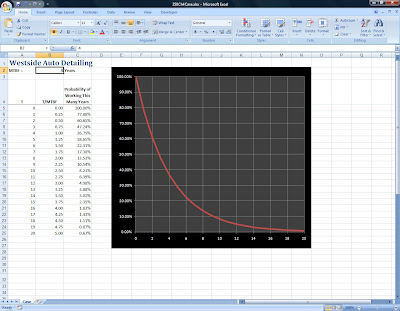

Although it is hard to quantify just how much effect the Internet had, I believe that without the influence of the two factors described above, the markets’ decline would not have been as steep. The Dow Jones Industrial Average began heading down in May 2008:

In late September, the panic started. Nervous investors began to sell off. At fiber optic speeds, this news traveled around the world in seconds. During that first week of October, like an electronic shock wave, you could follow the daily decline around the globe by watching what the European and Asian markets were doing. By the time trading started in the United States, the panic selling began anew. The news media helped to perpetuate the problem by continually interviewing so called “experts” who—each not wanting to be outdone by their peers—gave a more dire prediction of things to come. Typically, falling stock markets take a break from time to time, as investors buy up stocks at bargain prices. But this time the market’s psychology was anything but normal. Each time the stock market rallied—as it did on the morning of Oct. 9—”there were tons of sellers everywhere,” says Dave Rovelli, managing director of equity trading at Canaccord Adams. “People just wanted out.” Were these investors acting “rationally” or were they reacting to the panic spread by the Internet? According to a poll conducted in December 2008, no less than 77% of Americans believed that the U.S. media was making the economic situation worse by projecting fear into people's minds.

How much damage was done? The S&P 500, the broad U.S. stock index, lost 22% of its value in six trading sessions, from Oct. 2 to Oct. 9. Brian Gendreau of ING Investment Management points out that the Dow Jones industrial Average, until October 2008, had never seen six consecutive daily declines of 1% or more. To put the harm done to individuals in “dollars and cents,” the Congressional Budget Office estimates that the turmoil wiped out roughly $2 trillion of Americans’ retirement savings. Panic in financial markets—just as in everyday life—is explained by the fight-or-flight instinct. “That makes people overreact,” says Avanidhar Subrahmanyam, a professor and expert on market psychology at the UCLA Anderson School of Management. Subrahmanyam is convinced the markets were behaving irrationally. It’s not as if we’ve had a nuclear war and “real” assets were destroyed, he says. Rather, problems are in the financial sector, not the “real” activity in the rest of the economy. “The real, nonfinancial base of the economy is still fairly strong,” he says—far stronger than during, for example, the Great Depression.

Was the Internet at least partially responsible for the severity of this crash? We know that this “panic” was more psychological than reality based. And we know that through on-line trading, anyone regardless of their knowledge can follow the progress of world markets 24/7 and place a buy or sell order instantly. The media’s role cannot be ignored either. We all saw and heard the endless parade of bad news on our TV’s and computer screens each night. Richard Scheff, a national expert on corporate liability and white collar crime issues, warns media that they could potentially be exposed to liability despite apparent constitutional protections: “Although statements by the media are protected by the First Amendment… …One would hope that the media would act less out of self-interest in these times of national crisis,” said Mr. Scheff, vice chairman and partner with Philadelphia-based law firm Montgomery McCracken Walker & Rhoads.

Consider the type of investor who trades on-line. Winston W. Way, Jr. of Buckhorn Capital has identified several types of Internet traders, the “Gambler,” the “Social Climber,” the “Hobbyist,” and the “Manager.” Of these, the Gambler—especially the day-trader—is perhaps the most dangerous and a real threat to market stability. Day-traders represent the extreme of this subtype, and they often have compulsive or addictive personality types. Their pace of activity is frenetic, involving dozens of trades daily, and astronomical portfolio turnover. The more typical, garden-variety gambler may make several trades per week or month from his office PC, but they typically check their stocks and the market 4-6 times a day. The gambler is involved in the market for the rush, fast action, and the idea of getting something for nothing. Many are wheeler-dealer-big-shot wannabes. They tend to be males between 25 and 45, and they may constitute close to half of all online investors.

The Social Climber is motivated by appearances and displaying a high-status life style. For social climbers, stock market participation is a badge, clearly marking them as players in an elite game, which they perceive as an exclusive preserve of the wealthy. Like gamblers, they will frequently shun mutual funds or bonds as being too pedestrian. They want to have interesting stories with some sizzle and an element of gossip to tell about their market experiences at cocktail parties or in the locker-room after a round of golf. They are interested in making money, but this is frequently secondary to their desire to impress other people, and define themselves as part of the country club set.

Another subtype is the Hobbyist, who is usually an individual with a deep intellectual fascination with the financial markets. This person has an insatiable appetite for information of all kinds about the markets and securities of all kinds. Business school professors tend to fall into this category (this characterizes my own involvement). They are relatively few in number.

The Manager is the final subtype. This investor is usually well organized and is motivated by a need to be in control. They often run their personal affairs (including investments and finances) with the same attention to detail that characterizes their business life. These people tend to be fairly young, intensely responsible types who are just starting to build their net worth, or they tend to be retired workaholics who cannot endure having nothing "important" to do. They constitute a very meaningful segment of the market.

Inexperience tends to be the common weakness among most Internet traders. The vast majority are newcomers to investing, and have only been involved for a few years at most. Way believes that this has resulted in a greater measure of irrationality being injected into the market and wonders how much this trend may be contributing to the recent rise in overall volatility. Finally, Way questions how these inexperienced investors might behave in a bear market situation. Will they panic and make a bad situation worse?

Unfortunately, we now know the answer to that question. As of late Spring 2009, the decline seems to have ended and the markets are beginning to advance once more. There are signs that the housing crisis is easing and there is still high approval for the Obama administration. But we are left with many important unanswered questions. Can this happen again? If so, then how do we minimize the damage? Should small individual investor’s accounts be insured the way savings and checking accounts are? Should Internet trading by non-professional investors be regulated? Should we also hold the media accountable for irresponsible reporting? Certainly most would agree the major news organizations should be held responsible for what they themselves publish and what sort of comments they allow to be posted on their Web sites.

Compared with other forms of communication, the Internet is still relatively young and is evolving. The freedom of the Internet as a medium of expression and instant access to information on almost any topic are its main strengths. We can learn to interpret and discard much of the disinformation but when irrational panic spreads just as quickly, costing people their life savings and jobs, something is clearly wrong with the system.

The Stock Market Crash of 2008 was devastating to millions of Americans but came at a time of general prosperity. Although there were concerns about the housing market and gasoline prices had hit record levels that summer, there were many signs that the economy was fundamentally strong. The behavior of investors seemed to be irrational—almost as if some force other than economic was driving the decline. Experts have debated all of the possible causes from declining “consumer confidence” to “short selling” to the fact that it was an election year. Undoubtedly there were many factors involved. Is it possible that the Internet itself contributed to the market’s decline?

Over the past several years the marketplace has changed radically, and this is largely due to the revolution created by Internet trading. Prior to 1995, individual investors gained access to the financial markets almost exclusively through full service brokers, discount brokers, or mutual funds. Since then, on-line services like E-Trade, Ameritrade, Scottrade, and others have allowed millions of ordinary investors with relatively limited funds and knowledge the ability to participate in the markets. At the same time, the Internet has given us 24/7 access to information around the world at increasingly faster speeds. While almost all would agree that this free access to information is one of the great social benefits of the Internet, it is also a completely unregulated and unedited source of information. This characteristic has lead to many “urban legends” and disinformation being spread as well. In his book, The Cult of the Amateur, English author Andrew Keen makes the case that that the web is dumbing itself down by replacing the authoritative knowledge of experts with the flawed “wisdom of the crowd.”

Although it is hard to quantify just how much effect the Internet had, I believe that without the influence of the two factors described above, the markets’ decline would not have been as steep. The Dow Jones Industrial Average began heading down in May 2008:

In late September, the panic started. Nervous investors began to sell off. At fiber optic speeds, this news traveled around the world in seconds. During that first week of October, like an electronic shock wave, you could follow the daily decline around the globe by watching what the European and Asian markets were doing. By the time trading started in the United States, the panic selling began anew. The news media helped to perpetuate the problem by continually interviewing so called “experts” who—each not wanting to be outdone by their peers—gave a more dire prediction of things to come. Typically, falling stock markets take a break from time to time, as investors buy up stocks at bargain prices. But this time the market’s psychology was anything but normal. Each time the stock market rallied—as it did on the morning of Oct. 9—”there were tons of sellers everywhere,” says Dave Rovelli, managing director of equity trading at Canaccord Adams. “People just wanted out.” Were these investors acting “rationally” or were they reacting to the panic spread by the Internet? According to a poll conducted in December 2008, no less than 77% of Americans believed that the U.S. media was making the economic situation worse by projecting fear into people's minds.

How much damage was done? The S&P 500, the broad U.S. stock index, lost 22% of its value in six trading sessions, from Oct. 2 to Oct. 9. Brian Gendreau of ING Investment Management points out that the Dow Jones industrial Average, until October 2008, had never seen six consecutive daily declines of 1% or more. To put the harm done to individuals in “dollars and cents,” the Congressional Budget Office estimates that the turmoil wiped out roughly $2 trillion of Americans’ retirement savings. Panic in financial markets—just as in everyday life—is explained by the fight-or-flight instinct. “That makes people overreact,” says Avanidhar Subrahmanyam, a professor and expert on market psychology at the UCLA Anderson School of Management. Subrahmanyam is convinced the markets were behaving irrationally. It’s not as if we’ve had a nuclear war and “real” assets were destroyed, he says. Rather, problems are in the financial sector, not the “real” activity in the rest of the economy. “The real, nonfinancial base of the economy is still fairly strong,” he says—far stronger than during, for example, the Great Depression.

Was the Internet at least partially responsible for the severity of this crash? We know that this “panic” was more psychological than reality based. And we know that through on-line trading, anyone regardless of their knowledge can follow the progress of world markets 24/7 and place a buy or sell order instantly. The media’s role cannot be ignored either. We all saw and heard the endless parade of bad news on our TV’s and computer screens each night. Richard Scheff, a national expert on corporate liability and white collar crime issues, warns media that they could potentially be exposed to liability despite apparent constitutional protections: “Although statements by the media are protected by the First Amendment… …One would hope that the media would act less out of self-interest in these times of national crisis,” said Mr. Scheff, vice chairman and partner with Philadelphia-based law firm Montgomery McCracken Walker & Rhoads.

Consider the type of investor who trades on-line. Winston W. Way, Jr. of Buckhorn Capital has identified several types of Internet traders, the “Gambler,” the “Social Climber,” the “Hobbyist,” and the “Manager.” Of these, the Gambler—especially the day-trader—is perhaps the most dangerous and a real threat to market stability. Day-traders represent the extreme of this subtype, and they often have compulsive or addictive personality types. Their pace of activity is frenetic, involving dozens of trades daily, and astronomical portfolio turnover. The more typical, garden-variety gambler may make several trades per week or month from his office PC, but they typically check their stocks and the market 4-6 times a day. The gambler is involved in the market for the rush, fast action, and the idea of getting something for nothing. Many are wheeler-dealer-big-shot wannabes. They tend to be males between 25 and 45, and they may constitute close to half of all online investors.

The Social Climber is motivated by appearances and displaying a high-status life style. For social climbers, stock market participation is a badge, clearly marking them as players in an elite game, which they perceive as an exclusive preserve of the wealthy. Like gamblers, they will frequently shun mutual funds or bonds as being too pedestrian. They want to have interesting stories with some sizzle and an element of gossip to tell about their market experiences at cocktail parties or in the locker-room after a round of golf. They are interested in making money, but this is frequently secondary to their desire to impress other people, and define themselves as part of the country club set.

Another subtype is the Hobbyist, who is usually an individual with a deep intellectual fascination with the financial markets. This person has an insatiable appetite for information of all kinds about the markets and securities of all kinds. Business school professors tend to fall into this category (this characterizes my own involvement). They are relatively few in number.

The Manager is the final subtype. This investor is usually well organized and is motivated by a need to be in control. They often run their personal affairs (including investments and finances) with the same attention to detail that characterizes their business life. These people tend to be fairly young, intensely responsible types who are just starting to build their net worth, or they tend to be retired workaholics who cannot endure having nothing "important" to do. They constitute a very meaningful segment of the market.

Inexperience tends to be the common weakness among most Internet traders. The vast majority are newcomers to investing, and have only been involved for a few years at most. Way believes that this has resulted in a greater measure of irrationality being injected into the market and wonders how much this trend may be contributing to the recent rise in overall volatility. Finally, Way questions how these inexperienced investors might behave in a bear market situation. Will they panic and make a bad situation worse?

Unfortunately, we now know the answer to that question. As of late Spring 2009, the decline seems to have ended and the markets are beginning to advance once more. There are signs that the housing crisis is easing and there is still high approval for the Obama administration. But we are left with many important unanswered questions. Can this happen again? If so, then how do we minimize the damage? Should small individual investor’s accounts be insured the way savings and checking accounts are? Should Internet trading by non-professional investors be regulated? Should we also hold the media accountable for irresponsible reporting? Certainly most would agree the major news organizations should be held responsible for what they themselves publish and what sort of comments they allow to be posted on their Web sites.

Compared with other forms of communication, the Internet is still relatively young and is evolving. The freedom of the Internet as a medium of expression and instant access to information on almost any topic are its main strengths. We can learn to interpret and discard much of the disinformation but when irrational panic spreads just as quickly, costing people their life savings and jobs, something is clearly wrong with the system.

Comments